UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ | | | Filed by a party other than the Registrant ☐ |

Check the appropriate box:

☐ | | | Preliminary Proxy |

☐ | |||

| | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

☒ | |||

| | Definitive Proxy Statement | ||

☐ | |||

| | Definitive Additional | ||

☐ | |||

| | Soliciting Material |

Precision BioSciences, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box)all boxes that apply):

☒ | ||||||

| | No fee | |||||

| | | | | |||

☐ | | | Fee paid previously with preliminary materials | |||

| | | | | |||

☐ | | | Fee computed on table | |||

Precision BioSciences, Inc.

302 East Pettigrew Street, Suite A-100

Durham, North Carolina 27701

March 27, 2020

23, 2023

Dear Fellow Stockholders:

On behalf of the Board of Directors, I cordially invite you to attend the 20202023 annual meeting of stockholders (the “Annual Meeting”) of Precision BioSciences, Inc., which will be held on Wednesday,Thursday, May 13, 2020,4, 2023, beginning at 11:00 a.m., Eastern Time. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast.

Attached to this letter are a Notice of Annual Meeting of Stockholders and Proxy Statement, which describe the business to be conducted at the meeting.

Your vote is important to us. Please act as soon as possible to vote your shares. It is important that your shares be represented at the meeting whether or not you plan to attend the Annual Meeting via the Internet. Please vote electronically over the Internet, by telephone or if you receive a paper copy of the proxy card by mail, by returning your signed proxy card in the envelope provided. You may also vote your shares online during the Annual Meeting. Instructions on how to vote while participating at the meeting live via the Internet are posted at www.virtualshareholdermeeting.com/DTIL2020DTIL2023.

On behalf of the Board of Directors and management, it is my pleasure to express our appreciation for your continued support.

| | | /s/ Kevin J. Buehler | |

| | | Kevin J. Buehler | |

| | Chair of the Board |

Precision BioSciences, Inc.

302 East Pettigrew Street, Suite A-100

Durham, North Carolina 27701

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 13, 20204, 2023

NOTICE IS HEREBY GIVENthat the Annual Meeting of Stockholders of Precision BioSciences, Inc., a Delaware corporation, will be held on Wednesday,Thursday, May 13, 2020,4, 2023, at 11:00 a.m., Eastern Time. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/DTIL2020DTIL2023. For instructions on how to attend and vote your shares at the Annual Meeting, see the information in the accompanying Proxy Statement in the section titled “General Information about the Annual Meeting and Voting—How can I attend and vote at the Annual Meeting?”

The Annual Meeting is being held:

| 1. | to elect Michael Amoroso and Geno Germano |

| 2. | to ratify |

| 3. | to transact such other business as may properly come before the Annual Meeting or any continuation, postponement or adjournment thereof. |

These items of business are described in the Proxy Statement that follows this notice. Holders of record of our common stock as of the close of business on March 23, 20209, 2023 are entitled to notice of and to vote at the Annual Meeting, or any continuation, postponement or adjournment thereof.

Your vote is important. Voting your shares will ensure the presence of a quorum at the Annual Meeting and will save us the expense of further solicitation. Please promptly vote your shares by following the instructions for voting on the Notice Regarding the Availability of Proxy Materials or, if you received a paper or electronic copy of our proxy materials, by completing, signing, dating and returning your proxy card or by Internet or telephone voting as described on your proxy card.

| | | By Order of the Board of Directors | |

| | | ||

| | | /s/ Dario Scimeca | |

| | | Dario Scimeca | |

| | | General Counsel and Secretary |

Durham, North Carolina

March 27, 2020

23, 2023

This Notice of Annual Meeting and Proxy Statement are first being distributed or made available, as the case may be, on or about March 27, 2020.

23, 2023.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting:

This Proxy Statement and our Annual Report are available free of charge at www.proxyvote.com.

TABLE OF CONTENTS

CONTENTS

| | | | | Page | ||

| | | |||||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | ||||||

| What does it mean if I receive more than one | | | ||||

| | ||||||

| Who is entitled to vote at the Annual Meeting? | | | ||||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | |||||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | |||||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | ||||

| | ||||||

| | | | | |||

| | | | | Page | ||

| | | |||||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | ||||||

| | | |||||

| | | |||||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | ||||

| | | |||||

| | | | | |||

| | | | | |||

| | | | | |||

| | ||||||

| | | | | |||

| | | | | |||

| | | | ||||

| | ||||||

| Director and Officer Indemnification and Insurance | | | ||||

| | | | | |||

| | | | | |||

| | | | ||||

| | ||||||

| | | | | |||

| | | |||||

| | | | | |||

| | ||||||

Precision BioSciences, Inc.

302 East Pettigrew Street, Suite A-100

Durham, North Carolina 27701

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 13, 2020

4, 2023

This proxy statement (the “Proxy Statement”) and our annual report for the fiscal year ended December 31, 20192022 (the “Annual Report” and, together with this Proxy Statement, the “proxy materials”) are being furnished by and on behalf of the board of directors (the “Board” or “Board of Directors”) of Precision BioSciences, Inc. (the “Company,” “Precision,” “we,” “us,” or “our”), in connection with our 20202023 annual meeting of stockholders (the “Annual Meeting”). The Notice of Annual Meeting and this Proxy Statement are first being distributed or made available, as the case may be, on or about March 27, 2020.23, 2023.

The Annual Meeting will be held on Wednesday,Thursday, May 13, 20204, 2023 at 11:00 a.m., Eastern Time. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/DTIL2020DTIL2023 and entering your 16-digit control number included in your Notice of Internet Availability of Proxy Materials, on your proxy card or on the instructions that accompanied your proxy materials. If you lose your 16-digit control number, you may join the Annual Meeting as a “Guest”, but you will not be able to vote, ask questions or access the list of stockholders as of the as of the close of business on March 23, 20209, 2023 (the “Record Date”).

The purpose of the Annual Meeting is to vote on the following items described in this Proxy Statement:

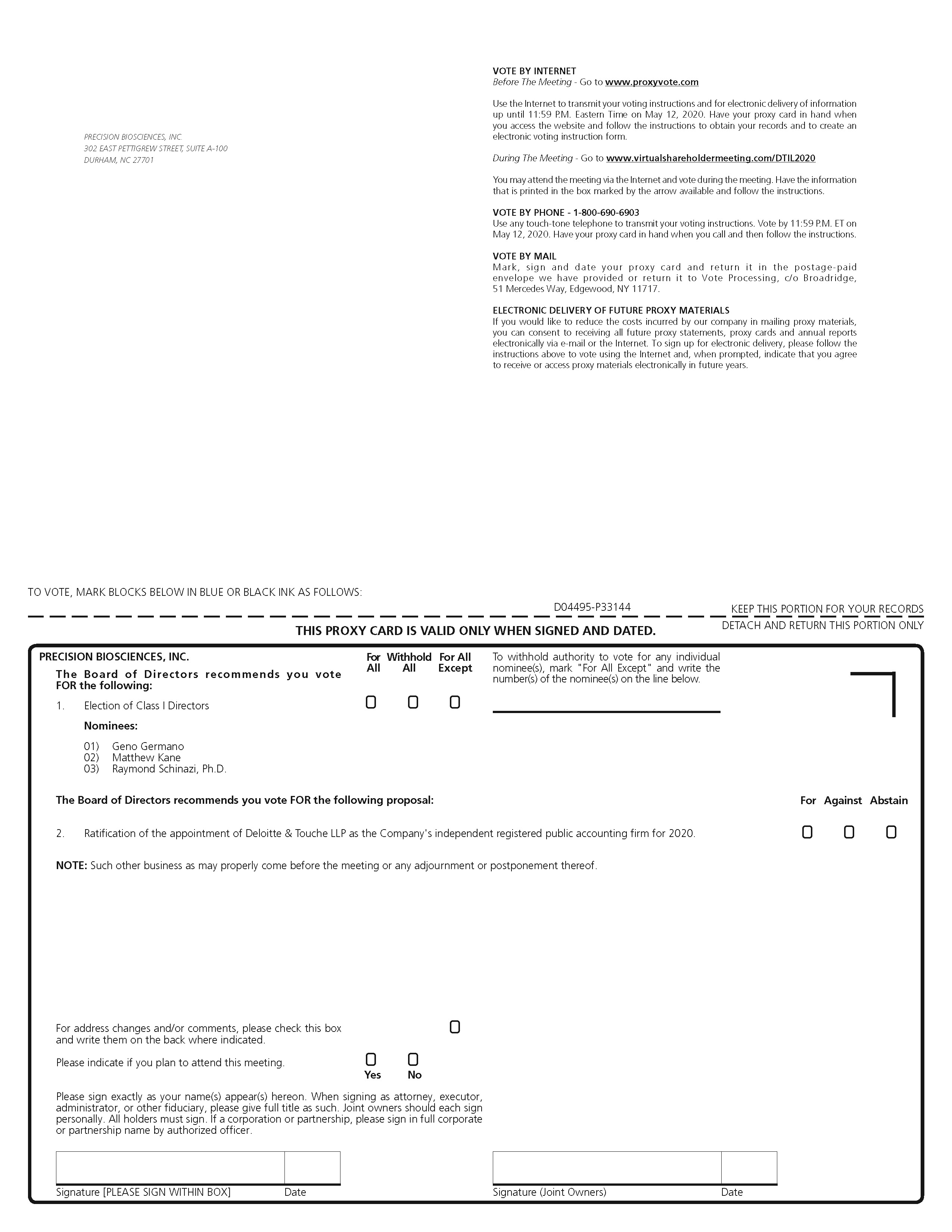

Proposal No. 1: Election of the director nominees listed in this Proxy Statement.

Proposal No. 2: Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2020.

Are there any matters to be voted on at the Annual Meeting that are not included in this Proxy Statement?

At the date this Proxy Statement went to press, we did not know of any matters to be properly presented at the Annual Meeting other than those referred to in this Proxy Statement. If other matters are properly presented at the meeting or any adjournment or postponement thereof for consideration, and you are a stockholder of record and have submitted a proxy card, the persons named in your proxy card will have the discretion to vote on those matters for you.

What does it mean if I receive more than one Notice and Access Card or more than one set of proxy materials?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all of your shares are voted, for each Notice and Access Card or set of proxy materials, please submit your proxy by phone, via the Internet, or if you received printed copies of the proxy materials, by signing, dating and returning the enclosed proxy card in the enclosed envelope.

Holders of record of shares of our common stock as of the close of business on the Record Date will be entitled to notice of and to vote at the Annual Meeting and any continuation, postponement or adjournment thereof.

1

At the close of business on the Record Date, there were 51,414,924111,696,402 shares of our common stock issued and outstanding and entitled to vote. Each share of our common stock is entitled to one vote on any matter presented to stockholders at the Annual Meeting. You will need to obtain your own Internet access if you choose to attend the Annual Meeting online and/or vote over the Internet.

To attend and participate in the Annual Meeting, you will need the 16-digit control number included in your Notice and Access Card, on your proxy card or on the instructions that accompanied your proxy materials. If your shares are held in “street name,” you should contact your bank or broker to obtain your 16-digit control number or otherwise vote through the bank or broker. If you lose your 16-digit control number, you may join the Annual Meeting as a “Guest”“Guest,” but you will not be able to vote, ask questions or access the list of stockholders as of the Record Date. The meeting webcast will begin promptly at 11:00 a.m., Eastern Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 10:45 a.m., Eastern Time, and you should allow ample time for the check-in procedures.

A record holder (also called a “registered holder”) holds shares in his or her name. Shares held in “street name” means that shares are held in the name of a bank, broker or other nominee on the holder’s behalf.

If your shares are held in a brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” of shares held in “street name.” The Notice and Access Card or the proxy materials if you elected to receive a hard copy, hashave been forwarded to you by your broker, bank or other nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank or other holder of record on how to vote your shares by following their instructions for voting. Please refer to information from your bank, broker or other nominee on how to submit your voting instructions.

A quorum must be present at the Annual Meeting for any business to be conducted. The holders of a majority in voting power of the Company’s capital stock issued and outstanding and entitled to vote, present electronically or represented by proxy constitutes a quorum. If you sign and return your paper proxy card or authorize a proxy to vote electronically or telephonically, your shares will be counted to determine whether we have a quorum even if you abstain or fail to vote as indicated in the proxy materials.

Broker non-votes will also be considered present for the purpose of determining whether there is a quorum for the Annual Meeting.

A “broker non-vote” occurs when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a proposal because (1) the broker has not received voting instructions from the stockholder who beneficially owns the shares and (2) the broker lacks the authority to vote the shares at their discretion. Proposal No. 1 is considered a non-discretionary matter, and a broker will lack the authority to vote uninstructed shares at their discretion on such proposal. Proposal No. 2 is considered a discretionary matter, and a broker will be permitted to exercise its discretion to vote uninstructed shares on this proposal.

If a quorum is not present or represented at the scheduled time of the Annual Meeting, (i) the chairperson of the Annual Meeting or (ii) a majority in voting power of the stockholders entitled to vote at the Annual Meeting, present electronically or represented by proxy, may adjourn the Annual Meeting until a quorum is present or represented.

2

We recommend that stockholders vote by proxy even if they plan to attend the Annual Meeting and vote electronically. If you are a stockholder of record, there are three ways to vote by proxy:

by Telephone—You can vote by telephone by calling 1-800-690-6903 and following the instructions on the proxy card;

by Internet—You can vote over the Internet at www.proxyvote.com by following the instructions on the Notice and Access Card or proxy card; or

by Mail—You can vote by mail by signing, dating and mailing the proxy card, which you may have received by mail.

card.

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m., Eastern Time, on May 12, 2020.

3, 2023.

If your shares are held in the name of a bank, broker or other holder of record, you will receive instructions on how to vote from the bank, broker or holder of record. You must follow the instructions of such bank, broker or holder of record in order for your shares to be voted.

We will be hosting the Annual Meeting live via audio webcast. Any stockholder can attend the Annual Meeting live online at www.virtualshareholdermeeting.com/DTIL2020DTIL2023. If you were a stockholder as of the Record Date, or you hold a valid proxy for the Annual Meeting, you can vote at the Annual Meeting. A summary of the information you need to attend the Annual Meeting online is provided below:

Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/DTIL2020DTIL2023..

Assistance with questions regarding how to attend and participate via the Internet will be provided at www.virtualshareholdermeeting.com/DTIL2020DTIL2023 on the day of the Annual Meeting.

Webcast starts at 11:00 a.m., Eastern Time.

You will need your 16-Digit Control Number to enter the Annual Meeting.

Stockholders may submit questions while attending the Annual Meeting via the Internet.

To attend and participate in the Annual Meeting, you will need the 16-digit control number included in your Notice and Access Card, on your proxy card or on the instructions that accompanied your proxy materials. If your shares are held in “street name,” you should contact your bank or broker to obtain your 16-digit control number or otherwise vote through the bank or broker. If you lose your 16-digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote, ask questions or access the list of stockholders as of the Record Date.

What if during the check-in time or during the Annual Meeting I have technical difficulties or trouble accessing the virtual meeting website?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website. If you encounter any difficulties accessing the virtual meeting website during the check-in or meeting time, please call the technical support number that will be posted on the Annual Meeting login page.

The Board recommends that you vote:

FORthe nominees to the Board set forth in this Proxy Statement.

FORthe ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2020.2023.

3

The table below summarizes the proposals that will be voted on, the vote required to approve each item and how votes are counted:

Proposal | | | Votes Required | | | Voting Options | | | Impact of “Withhold” or “Abstain” Votes | | | Broker Discretionary Voting Allowed |

Proposal No. 1: Election of Directors | | | The plurality of the votes cast. This means that | | | “FOR ALL” “WITHHOLD ALL” “FOR ALL EXCEPT” | | | None(1) | | | No(3) |

| | | | | | | | | |||||

Proposal No. 2: Ratification of Appointment of Independent Registered Public Accounting Firm | | | The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively (excluding abstentions) at the Annual Meeting by the holders entitled to vote thereon. | | | “FOR” “AGAINST” “ABSTAIN” | | | None(2) | | | Yes(4) |

| (1) | Votes that are “withheld” will have the same effect as an abstention and will not count as a vote “FOR” or “AGAINST” a director, because directors are elected by plurality voting. |

| (2) | A vote marked as an “Abstention” is not considered a vote cast and will, therefore, not affect the outcome of this proposal. |

| (3) | As this proposal is not considered a discretionary matter, brokers lack authority to exercise their discretion to vote uninstructed shares on this proposal. |

| (4) | As this proposal is considered a discretionary matter, brokers are permitted to exercise their discretion to vote uninstructed shares on this proposal. |

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote in accordance with the recommendations of the Board. The Board’s recommendations are set forth above, as well as with the description of each proposal in this Proxy Statement.

Representatives of Broadridge Investor Communications Services (“Broadridge”) will tabulate the votes, and a representative of Broadridge will act as inspector of election.

Yes. Whether you have voted by Internet, telephone or mail, if you are a stockholder of record, you may change your vote and revoke your proxy by:

sending a written statement to that effect to the attention of our General Counsel and Secretary at our corporate offices, provided such statement is received no later than May 12, 2020;3, 2023;

voting again by Internet or telephone at a later time before the closing of those voting facilities at 11:59 p.m., Eastern Time, on May 12, 2020;3, 2023;

submitting a properly signed proxy card with a later date that is received no later than May 12, 2020;3, 2023; or

attending the Annual Meeting, revoking your proxy and voting again.

If you hold shares in street name, you may submit new voting instructions by contacting your bank, broker or other nominee. You may also change your vote or revoke your proxy online at the Annual Meeting if you obtain a signed proxy from the record holder (broker, bank or other nominee) giving you the right to vote the shares.

Your most recent proxy card or telephone or Internet proxy is the one that is counted. Your attendance at the Annual Meeting by itself will not revoke your proxy unless you give written notice of revocation to the Company before your proxy is voted or you vote online at the Annual Meeting.

4

We will pay the cost of soliciting proxies. Proxies may be solicited on our behalf by directors, officers or employees (for no additional compensation) in person or by telephone, electronic transmission and facsimile transmission. Brokers and other nominees will be requested to solicit proxies or authorizations from beneficial owners and will be reimbursed for their reasonable expenses.

We are excitedwish to continue using the latest technology to provide expanded access, improved communication and cost savings for our stockholders and the Company while providing stockholders the same rights and opportunities to participate as they would have at an in-person meeting. Furthermore, as part of our effort to maintain a safe and healthy environment for our directors, members of management and stockholders who wish to attend the Annual Meeting, in light of the novel coronavirus disease, COVID-19, we believe that hosting a virtual meeting is in the best interest of the Company and its stockholders and a virtual meeting enables increased stockholder attendance and participation because stockholders can participate from any location around the world.

As part of the Annual Meeting, we will hold a live Q&A session, during which we intend to answer appropriate questions submitted during the meeting and that relate to the matters to be voted on. We intend to reserve up to 10 minutes before the closing of the polls to address questions submitted. Only stockholders that have accessed the Annual Meeting as a stockholder (rather than a “Guest”) by following the procedures outlined above in “How can I attend and vote at the Annual Meeting?” will be able to submit questions during the Annual Meeting. Additionally, our Annual Meeting will follow “Rules of Conduct,” which will be available on our Annual Meeting webpage for stockholders that have accessed the Annual Meeting as a stockholder (rather than a “Guest”). Under these Rules of Conduct, a stockholder may ask up to two questions, and we will not address questions that are, among other things:

irrelevant to the business of the Company or to the business of the Annual Meeting;

related to the status or conduct of our clinical trials beyond that which is contained in our prior public disclosures;

related to material non-public information of the Company;

related to personal grievances;

derogatory references to individuals or that are otherwise in bad taste;

substantially repetitious of statements already made by another stockholder;

in furtherance of the stockholder’s personal or business interests; or

out of order or not otherwise suitable for the conduct of the Annual Meeting as determined by the Chair of the Annual Meeting or the Secretary in their reasonable judgment.

Additional information regarding the Q&A session will be available in the “Rules of Conduct” available on the Annual Meeting webpage for stockholders that have accessed the Annual Meeting as a stockholder (rather than a “Guest”) by following the procedures outlined above in “How can I attend and vote at the Annual Meeting?”.

5

Our amended and restated certificate of incorporation, as currently in effect (“Certificate of Incorporation”) provides that the number of directors shall be established from time to time by our Board of Directors. Our Board of Directors has fixed the number of directors at seven, and weWe currently have seven directors serving on the Board.

Our Certificate of Incorporation provides that the Board be divided into three classes, designated as Class I, Class II and Class III. Each class should consist, as nearly as may be possible, of one-third of the total number of directors constituting the entire Board. Each class of directors must stand for re-election no later than the third annual meeting of stockholders subsequent to their initial appointment or election to the Board, provided that the term of each director will continue until the election and qualification of his or her successor and is subject to his or her earlier death, resignation or removal. Generally, vacancies or newly created directorships on the Board will be filled only by vote of a majority of the directors then in office and will not be filled by the stockholders, unless the Board determines by resolution that any such vacancy or newly created directorship will be filled by the stockholders. A director appointed by the Board to fill a vacancy will hold office until the next election of the class for which such director was chosen, subject to the election and qualification of his or her successor and his or her earlier death, resignation or removal.

Our current directors and their respective classes and terms are set forth below.

Class I Director - Current Term Ending at | | | Class II Director – Current Term Ending at | | | Class III Director – Current Term Ending at | |

Michael Amoroso | | | Stanley R. Frankel, M.D. | | | Melinda Brown | |

Geno Germano | | | | | Kevin J. Buehler | ||

| | | | | Shari Lisa Piré |

Each person nominated for election has agreed to serve if elected, and management has no reason to believe that anyeither nominee will be unable to serve. If, however, prior to the Annual Meeting, the Board of Directors should learn that anyeither nominee will be unable to serve for any reason, the proxies that otherwise would have been voted for this nominee will be voted for a substitute nominee as selected by the Board. Alternatively, the proxies, at the Board’s discretion, may be voted for that fewer number ofno nominees as results from the inability of anyeither nominee to serve. The Board has no reason to believe that anyeither of the nominees will be unable to serve.

The following pages contain certain biographical information as of March 27, 202023, 2023 for each nominee for director and each director whose term as a director will continue after the Annual Meeting, including all positions he or she holds, his or her principal occupation and business experience for the past five years, and the names of other publicly-held companies of which the director or nomineenominees currently serves as a director or has served as a director during the past five years.

We believe that all of our directors and nominees: displaythe nominees have or display: personal and professional integrity; satisfactory levels of education and/or business experience; broad-based business acumen; an appropriate level of understanding of our business and its industry and other industries relevant to our business; the ability and willingness to devote adequate time to the work of our Board of Directors and its committees, as applicable; skills and personality that complement those of our other directors that helps build a board that is effective, collegial and responsive to the needs of our Company; strategic thinking and a willingness to share ideas;

6

a diversity of experiences, expertise and background; and the ability to represent the interests of all of our stockholders. The information presented below regarding each nomineethe nominees and continuing directordirectors also sets forth specific experience, qualifications, attributes and skills that led our Board of Directors to the conclusion that such individual should serve as a director in light of our business and structure.

Class III Director | | | Age | | | Served as a Director Since | | | Current Positions with Precision |

Michael Amoroso | | | 45 | | | 2021 | | | President, Chief Executive Officer and Director |

Geno Germano | | | 62 | | | 2020 | | | Director |

Class I Directors | Age | Served as a Director Since | Current Positions with Precision |

Geno Germano | 59 | 2020 | Director |

Matthew Kane | 43 | 2006 | President, Chief Executive Officer and Director |

Raymond Schinazi, Ph.D. | 70 | 2019 | Director |

Michael Amoroso has been our Chief Executive Officer and a member of our Board of Directors since October 2021. Mr. Amoroso most recently served as President, Chief Executive Officer and a director of Abeona Therapeutics (“Abeona”), a publicly traded clinical-stage biopharmaceutical company developing gene and cell therapies for life-threatening rare genetic diseases, from March 2021 to October 2021, and subsequently assumed the role of Chairman of the board of directors for Abeona in October 2021. Mr. Amoroso joined Abeona in July 2020 as Chief Commercial Officer and was promoted to Chief Operating Officer, leading all functions and serving as principal executive officer from November 2020 to March 2021. From August 2018 to January 2020, Mr. Amoroso served as Senior Vice President and Head of Worldwide Commercial Operations for Cell Therapy at Kite Pharma, a biotechnology company and subsidiary of Gilead Sciences, Inc., where he led all operations and functions charged with bringing the first wide-spread CAR-T cell therapy, YESCARTA®, to world major markets while also preparing the organization for its future cell therapy pipeline. Prior to his time at Kite Pharma, Mr. Amoroso served in senior level or executive positions at Eisai Inc. from October 2017 to August 2018 and Celgene Corporation from 2011 to 2017. Mr. Amoroso has worked with companies in the small molecules, biologics, and cell and gene therapies space across large, medium, and small capitalization companies with his deepest areas of expertise in rare and oncology diseases. Mr. Amoroso earned his Executive M.B.A. in Management from the Stern School of Business, New York University, and his B.A. in Biological Sciences, summa cum laude, from Rider University. Mr. Amoroso's qualifications to serve on our Board include his extensive experience in leading teams, either directly or indirectly, across clinical development, regulatory and medical affairs, corporate affairs, and commercial, both in the United States and globally, with direct operational experience in various pharmaceutical companies.

Geno Germano has served as a member of our Board of Directors since March 2020. Since August 2018, Mr. Germano has served as President and Chief Executive Officer and as a board member of Elucida Oncology, Inc. (“Elucida”), a biotechnology company, since August 2018.company. As President and CEO of Elucida, Mr. Germano leads strategic efforts to utilize Elucida’s ultra-smallultrasmall C-dot cancer targeting particle platform across diagnostic imaging, surgical and therapeutic applications. He served as President of Intrexon Corporation (“Intrexon”), a leader in engineering and industrialization of biology, from June 2016 to March 2017. Prior to joining Intrexon, from February 2014 to February 2016, Mr. Germano was Group President of the Global Innovative Pharma Business of Pfizer Inc. (“Pfizer”), where he led a growing global $14 billion business with market-leading medicines and an extensive portfolio of late-stage development candidates in several therapeutic areas including cardiovascular, metabolic disease, neuroscience, inflammation, immunology, and rare diseases. Mr. Germano was also Co-Chair of the Portfolio Strategy and Investment Committee at Pfizer, focused on maximizing the return on research and development investment across the Pfizer portfolio from 2013 to 2016. Previously, fromFrom 2009 through 2013, Mr. Germano served as President and General Manager of Pfizer’s Specialty Care and Oncology business units where he led commercial, medical, and post proof-of-concept pipeline strategy and development across global markets, and as Executive Vice President of the Vaccines Business.markets. Mr. Germano also currently serves on the board of directors of Sage Therapeutics, Inc. Mr. Germano previously served on the boards of Bioverativ, Inc and The Medicines Company. From 2008 to 2018, Mr. Germano was a Trustee of the Albany College of Pharmacy & Health Sciences. Mr. Germano received his Bachelor of Science in Pharmacy from Albany College of Pharmacy.

7

Class II Directors | | | Age | | | Director Since | | | Current Position at Precision |

Stanley R. Frankel, M.D. | | | 64 | | | 2021 | | | Director |

Samuel Wadsworth, Ph.D. | | | 74 | | | 2021 | | | Director |

Class II Directors | Age | Director Since | Current Position at Precision |

Derek Jantz, Ph.D. | 44 | 2006 | Chief Scientific Officer and Director |

Tony Yao, M.D., Ph.D. | 48 | 2018 | Director |

Stanley R. Frankel, M.D.,Derek Jantz, Ph.D. a co-founder of Precision, has been our Chief Scientific Officer since August 2013 and has served on our boardBoard of directorsDirectors since January 2006.April 2021. Dr. Frankel is a hematologist-oncologist with extensive academic and industry experience in the research, clinical development, and commercialization of immuno-oncology and cellular therapies. He previouslyhas led clinical development programs for multiple FDA-approved drugs to treat hematologic malignancies including acute lymphoblastic leukemia, multiple myeloma, and lymphoma. He currently serves as an independent advisor and consultant to biotechnology and pharmaceutical companies. From April 2021 through October 2022, Dr. Frankel served as ourthe Chief Medical Officer of Cytovia Therapeutics, Inc. providing clinical research and development leadership and strategic guidance for a portfolio of multi-specific natural killer (“NK”) cell engager antibodies and induced pluripotent stem cell derived NK cell therapeutic candidates. From November 2019 to October 2020, Dr. Frankel was Senior Vice President, Global Drug Development, Cellular Therapy at Bristol-Myers Squibb Co. and, from April 2015 to November 2019 was Corporate Vice President, Head of ScientificImmuno-Oncology and Cellular Therapy, Clinical Research and Development from our inception in 2006 to August 2013.at Celgene Corp. Dr. Jantz isFrankel serves on the co-inventorBoard of severalMyeloid Therapeutics. Dr. Frankel has been an Adjunct Associate Professor of our foundational patentsMedicine at Columbia University’s Division of Hematology/Oncology since 2009 and other intellectual property. As a protein engineer, he was an early developer of zinc finger technology and has spent most of his research career designing proteins for genome editing applications. Dr. JantzFrankel received a B.A. in biologyApplied Sciences, Biomechanics from the University of Colorado at BoulderHarvard College and a Ph.D. in biophysicsan M.D. from the Johns Hopkins University School of Medicine.Northwestern University. We believe that Dr. Jantz’s extensiveFrankel’s background and more than 20 years of experience in genome editingclinical development and as an inventor of ARCUS, our genome editing platform, in addition to his perspective as one of our founders and senior executives,hematologic malignancies qualifies him to serve on our boardBoard of directors.Directors.

Samuel Wadsworth, Ph.D.,Tony Yao, M.D., Ph.D. has served on our boardBoard of directorsDirectors since May 2018.November 2021. Dr. Wadsworth has authored over 80 peer-reviewed papers including some of the earliest published work on adeno-associated viral (“AAV”) vectors for gene therapies and owns over a dozen patents related to AAV vectors for gene therapies. Since April 2012, Dr. YaoWadsworth has served as Senior Scientific Advisor of Ultragenyx Pharmaceuticals Inc. (“Ultragenyx”), a portfolio manager at ArrowMark Partners, an asset management firm, where he leads the healthcare teambiopharmaceutical company, since April 2022, and manages the healthcare portfolio. Dr. Yao currently serves on the boardfrom November 2017 through April 2022 served as Ultragenyx’s Chief Scientific Officer with responsibility for discovery and research and development of directorsgene therapy programs, following Ultragenyx’s acquisition of 4D MolecularDimension Therapeutics, Inc., where Dr. Wadsworth served as Chief Scientific Officer from 2013 until November 2017. From 2010 to 2013, Dr. Wadsworth served as the Director of Molecular Biology at Genzyme Corporation and, NexImmune, Inc.subsequent to the acquisition by Sanofi S.A. in 2011, the Global Head of Gene Therapy overseeing discovery and translational research on multiple rare disease and gene therapy programs. Dr. Yao began his investment career in February 2002 as an analyst and later an assistant portfolio manager at Janus Capital Group. Dr. Yao receivedWadsworth’s academic credentials include a Sc.B. in biochemistryPh.D. from Brownthe University of Chicago and a M.D. and Ph.D. in immunologyB.A. from StanfordSouthern Illinois University. We believe that Dr. Yao’s medical background andWadsworth’s nearly 30 years of experience in private equity investing, particularly with healthcare companies, qualifythe biotechnology industry qualifies him to serve as a memberon our Board of our board of directors.Directors.

Class III Directors | | | Age | | | Director Since | | | Current Position at Precision |

Melinda Brown | | | 66 | | | 2022 | | | Director |

Kevin J. Buehler | | | 65 | | | 2019 | | | Chair of the Board |

Shari Lisa Piré | | | 58 | | | 2021 | | | Director |

Class III Directors | Age | Director Since | Current Position at Precision |

Kevin J. Buehler | 62 | 2019 | Interim Chair of the Board |

Shalini Sharp | 45 | 2018 | Director |

Melinda BrownKevin J. Buehler has served on our boardBoard of directorsDirectors since May 2022. Ms. Brown is a financial expert with proven experience leading accounting, finance and enterprise risk management teams in large, public companies. Ms. Brown served as Senior Vice President and Controller of Tapestry, Inc. (“Tapestry”), a multinational luxury fashion holding company, from September 2012 until her retirement in March 2019. In this capacity, she led, redefined and enhanced the global control function, as well as participated as a key member in the leadership team supporting Tapestry’s significant growth initiatives, including the acquisition and integration of Kate Spade and Stuart Weitzman brands and their multi-functional SAP implementation. Prior to Tapestry, Ms. Brown spent 30 years with PepsiCo, Inc. (“PepsiCo”), a multinational food, snack and beverage company, with her most recent role as Senior Vice President, Global Financial Shared Services and Productivity where she led North American shared services centers, developed PepsiCo’s global finance outsourcing strategy and coordinated global efforts by the Company to deliver multi-year productivity commitments. Ms. Brown was previously Chair of The University of Connecticut Foundation, Incorporated Board of Directors, Audit Committee Chair and member of their Executive and Finance Committees.

8

Ms. Brown has also served as the Chief Financial Officer of The Draft Network, a sports-focused media company, since September 2021. Ms. Brown began her career at Coopers Lybrand followed by the Financial Accounting Standards Board. She received a Bachelor of Science in accounting and a Master of Business Administration from the University of Connecticut. She is a Certified Public Accountant and member of the American Institute of CPAs and Connecticut Society of CPAs. We believe that Ms. Brown’s extensive expertise in accounting, finance and enterprise risk management and leadership roles at public companies qualifies her to serve on our Board of Directors.

Kevin J. Buehler has served on our Board of Directors since November 2019 and, in MarchNovember 2020, was appointed Chair of the Board, after serving as the Interim Chair of the Board.Board since March 2020. Mr. Buehler has over 30 years of experience in the healthcare industry, having most recently served from April 2011 to May 2014 as the Division Head of Alcon Laboratories, Inc., a division of Novartis AG, a multinational pharmaceutical company. Prior to that, from April 2009 to April 2011, he served as the Chief Executive Officer and President of Alcon Inc., after having served from 2007 to 2009 as Alcon Inc.’s's Senior Vice President, Global Markets and Chief Marketing Officer and, from 20062005 to 2007, as its Senior Vice President of the U.S. market and the Chief Marketing Officer. Mr. Buehler began his career with Alcon, Inc. in August 1984. Mr. Buehler holds a B.A. degree from Carroll University in Waukesha, WI, with concentrations in Business Administration and Political Science, and is a graduate of the Harvard Executive Program for Management Development. Mr. Buehler also currently serves on the Read Fort Worth non-profit board of directors. We believe that Mr. Buehler’s more than 30 years of experience in the healthcare and industry, including both executive and board roles, qualifyqualifies him to serve as memberon our Board of our board of directors.Directors.

Shari Lisa PiréShalini Sharp has served on our boardBoard of directorsDirectors since December 2018. Since 2012,November 2021. Ms. SharpPiré has served as Executive Vice President and Chief Financial Officer of Ultragenyx Pharmaceutical Inc., a biopharmaceutical company, holding the position of Chief Financial Officer since May 2012 and the position of Executive Vice President since January 2016. Between May 2012 and January 2016, she served as Senior Vice President of Ultragenyx. Prior to Ultragenyx, Ms. Sharp served in various executive capacities, and ultimately as Chief Financial Officer, of Agenus Inc., a biotechnology company, from August 2003 until May 2012. Ms. Sharp currently serves on the board of directors of Neurocrine Biosciences, Inc.. and Sutro Biopharma, Inc. and previously served on the board of directors of Agenus, Inc. and Array BioPharma Inc. Ms. Sharp received a B.A. in English literature and an M.B.A. from Harvard University. We believe that Ms. Sharp’s more than 20 years of experience as a trusted advisor to public and private companies and their owners. Since May 2021, Ms. Piré has served as the Chief Legal & Sustainability Officer at Plume Design, Inc., offering an open and hardware-independent Software as-a-Service delivery platform for smart homes, small businesses and beyond, using Wi-Fi, AI and machine learning to create the future of commercial spaces and human experience. From April 2015 to April 2021, Ms. Piré served as Chief Legal Officer for Cognate BioServices, Inc. (“Cognate”), a biotechnology contract development and manufacturing organization (“CDMO”). An instrumental member of the senior leadership team for Cognate, Ms. Piré effectively led and negotiated all transactions across each stage of the business’s evolution from small startup to its eventual sale to Charles River Laboratories. From January 2020 to April 2021, Ms. Piré served as a board member of Cobra Biologics Ltd., a gene therapy-focused CDMO that Cognate acquired under her leadership. Ms. Piré holds a B.A. in French Literature from the University of California at Irvine and a Juris Doctor, magna cum laude, from New York Law School. Ms. Piré served as Editor of the New York Law School Law Review and is admitted to the New York and D.C. Bars. Ms. Piré also currently serves on two non-profit boards of directors focused on children’s underserved medical needs and pediatric healthcare, respectively. We believe that Ms. Piré’s more than 20 years of experience providing legal advice to companies, including in the life sciences industry, including both executive and board roles as well as her expertise in biotechnology, corporate strategy and finance qualifyqualifies her to serve as a memberon our Board of our board of directors.

The Board of Directors unanimously recommends a vote FOR the election of each of Michael Amoroso and Geno Germano Matthew Kane and Raymond Schinazi, Ph.D. as a Class I director to hold office until the 20232026 Annual Meeting and until his respective successor has been duly elected and qualified.

9

REGISTERED PUBLIC ACCOUNTING FIRM

The audit committee appoints our independent registered public accounting firm. In this regard, the audit committee evaluates the qualifications, performance and independence of our independent registered public accounting firm and determines whether to re-engage our current firm. As part of its evaluation, the audit committee considers, among other factors, the quality and efficiency of the services provided by the firm, including the performance, technical expertise, industry knowledge and experience of the lead audit partner and the audit team assigned to our account; the overall strength and reputation of the firm; the firm’s global capabilities relative to our business; and the firm’s knowledge of our operations. Deloitte & Touche LLP has served as our independent registered public accounting firm since 2017. Neither the accounting firm nor any of its members has any direct or indirect financial interest in or any connection with us in any capacity other than as our auditors and providing audit and permissible non-audit related services. Upon consideration of these and other factors, the audit committee has appointed Deloitte & Touche LLP to serve as our independent registered public accounting firm for the year ending December 31, 2020.

2023.

Although ratification is not required by our amended and restated by-laws (“Bylaws”) or otherwise, the Board is submitting the selection of Deloitte & Touche LLP to our stockholders for ratification because we value our stockholders’ views on the Company’s independent registered public accounting firm and it is a good corporate governance practice. If our stockholders do not ratify the selection, it will be considered as notice to the Board and the audit committee to consider the selection of a different firm. Even if the selection is ratified, the audit committee, in its discretion, may select a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

Representatives of Deloitte & Touche LLP are expected to attend the Annual Meeting and to have an opportunity to make a statement and be available to respond to appropriate questions from stockholders.

The following table sets forth the fees of Deloitte & Touche LLP, our independent registered public accounting firm, billed to Precision in each of the last two fiscal years (in thousands).

| Year Ended December 31, | ||||||||

| 2019 | 2018 | |||||||

Audit Fees | $ | 589 | $ | 1,428 | ||||

Audit-Related Fees | — | — | ||||||

Tax Fees | 25 | 62 | ||||||

All Other Fees | 2 | 2 | ||||||

Total | $ | 616 | $ | 1,492 | ||||

| | | Year Ended December 31, | ||||

| | | 2022 | | | 2021 | |

Audit Fees | | | $1,003 | | | $888 |

Audit-Related Fees | | | — | | | — |

Tax Fees | | | 32 | | | 28 |

All Other Fees | | | 6 | | | 6 |

Total | | | $1,041 | | | $922 |

Audit Fees

Audit fees consisted of the following:

Fees for the audit of our consolidated financial statements, the review of the unaudited interim financial statements included in our quarterly reports on Form 10-Q and other professional services provided in connectionassociated with statutory and regulatory filings or engagements.SEC registration statements.

Fees for assurance and related services that are reasonably related to the performance of the audit or review of the registrant's financial statements, including for assurance reporting on our historical financial information included in our SECshelf registration statement in connection with our initial public offering.

statement.

Tax Fees

Tax fees consisted of fees for tax compliance, tax advice, and tax planning services.

10

All Other Fees

All other fees consisted of subscription fees for accounting research software.

The formal written charter for our audit committee requires that the audit committee pre-approve all audit services to be provided to us, whether provided by our principal auditor or other firms, and all other services (review, attest and non-audit) to be provided to us by our independent registered public accounting firm, other than de minimis non-audit services approved in accordance with applicable SEC rules.

The audit committee has adopted a policy (the “Pre-Approval Policy”) that sets forth the procedures and conditions pursuant to which audit and non-audit services proposed to be performed by our independent registered public accounting firm may be pre-approved. The Pre-Approval Policy generally provides that the audit committee will not engage an independent registered public accounting firm to render any audit, audit-related, tax or permissible non-audit service unless the service is either (i) explicitly approved by the audit committee (“specific pre-approval”) or (ii) entered into pursuant to the pre-approval policies and procedures described in the Pre-Approval Policy (“general pre-approval”). Unless a type of service to be provided by our independent registered public accounting firm has received general pre-approval under the Pre-Approval Policy, it requires specific pre-approval by the audit committee or by a designated member of the audit committee to whom the committee has delegated the authority to grant pre-approvals. Any member of the audit committee to whom the committee delegates authority to make pre-approval decisions must report any such pre-approval decisions to the audit committee at its next scheduled meeting. If circumstances arise where it becomes necessary to engage the independent registered public accounting firm for additional services not contemplated in the original pre-approval categories or above the pre-approved amounts, the audit committee requires pre-approval for such additional services or such additional amounts. Any proposed services exceeding pre-approved cost levels or budgeted amounts will also require specific pre-approval. For both types of pre-approval, the audit committee will consider whether such services are consistent with the SEC’s rules of the Securities and Exchange Commission (“SEC”) on auditor independence.

On an annual basis, the audit committee reviews and generally pre-approves the services (and related fee levels or budgeted amounts) that may be provided by our independent registered accounting firm without first obtaining specific pre-approval from the audit committee. The audit committee may revise the list of general pre-approved services from time to time, based on subsequent determinations.

The above-described services provided to us by Deloitte & Touche LLP prior to our initial public offering were provided under engagements entered into prior to our adoption ofin accordance with our pre-approval policies and following our initial public offering, in accordance with such policies.procedures.

The Board of Directors unanimously recommends a vote FOR the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020.2023.

The audit committee operates pursuant to a charter which is reviewed annually by the audit committee. Additionally, a brief description of the primary responsibilities of the audit committee is included in this Proxy Statement under the discussion of “Corporate Governance— Audit Committee.” Under the audit committee charter, managementManagement is responsible for the preparation, presentation and integrity of the Company’s financial statements, the appropriateness of accounting principles and financial reporting policies and for establishing and maintaining our internal control over financial reporting. The independent registered public accounting firm is responsible for auditing our financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the United States.

In the performance of its oversight function, the audit committee reviewed and discussed with management and Deloitte & Touche LLP, as the Company’s independent registered public accounting firm, the Company’s audited financial statements for the fiscal year ended December 31, 2019.2022. The audit committee also discussed with the Company’s independent registered public accounting firm the matters required to be discussed by the applicable standardsrequirements of the Public Company Accounting Oversight Board (the “PCAOB”). and the SEC. In addition, the audit committee received and reviewed the written disclosures and the letters from the Company’s independent

11

registered public accounting firm required by applicable requirements of the PCAOB, regarding such independent registered public accounting firm’s communications with the audit committee concerning independence, and discussed with the Company’s independent registered public accounting firm their independence from the Company.

Based upon the review and discussions described in the preceding paragraph, the audit committee recommended to the Board that the Company’s audited financial statements be included in its Annual Report on Form 10-K for the fiscal year ended December 31, 20192022 filed with the SEC.

Submitted by the Audit Committee of the Company’s Board of Directors:

Melinda Brown (Chair)

Kevin J. Buehler

Shari Lisa Piré (former member of the Audit Committee)

12

The table below identifies and sets forth certain biographical and other information regarding our executive officers as of March 27, 2020.23, 2023. There are no family relationships among any of our executive officers or directors.

Executive Officer | Age | Position | In Current Position Since |

Matthew Kane | 43 | President, Chief Executive Officer and Director | 2006 |

Derek Jantz, Ph.D. | 44 | Chief Scientific Officer and Director | 2006 |

Abid Ansari | 42 | Chief Financial Officer | 2019 |

Christopher Heery, M.D. | 40 | Chief Medical Officer | 2019 |

Dario Scimeca | 45 | General Counsel and Secretary | 2019 |

Fayaz Khazi, Ph.D. | 47 | Chief Executive Officer, Elo Life Systems | 2018 |

David Thomson, Ph.D. | 59 | Chief Operating Officer | 2019 |

Executive Officer | | | Age | | | Position | | | In Current Position Since |

Michael Amoroso | | | 45 | | | President, Chief Executive Officer and Director | | | 2021 |

Alex Kelly | | | 56 | | | Chief Financial Officer | | | 2021 |

Alan List, M.D. | | | 68 | | | Chief Medical Officer | | | 2021 |

Dario Scimeca | | | 48 | | | General Counsel and Secretary | | | 2019 |

Jeff Smith, Ph.D. | | | 50 | | | Chief Research Officer | | | 2022 |

See pages page 7 and 8 of this Proxy Statement for the biography of Matthew Kane and Derek Jantz, Ph.D., respectively.Michael Amoroso.

Alex KellyAbid Ansari has served as our Chief Financial Officer since February 2019.May 2021. He was previously the interim Chief Financial Officer from January 2021 to May 2021 and the Chief Corporate Affairs Officer from October 2020 to January 2021. Mr. Ansari previouslyKelly joined Precision from Allergan plc (“Allergan”), a pharmaceutical company, where, from April 2015 to May 2020, he served as ourExecutive Vice President, Finance & Operations from July 2016 to February 2019. Prior to joining us,Corporate Affairs and Chief Communications Officer of Allergan and President of The Allergan Foundation. In these roles, Mr. AnsariKelly developed internal and external messaging that shaped the company culture and supported several successful company transformations including the recent merger with AbbVie, Inc. Previously, Mr. Kelly served as Senior Director, Deal FinanceVice President, Chief Integration Officer for Actavis plc (now Allergan) where he led back-to-back integration efforts for both the acquisition of Forest Laboratories, LLC (“Forest Labs”) and M&A from November 2013Allergan. Prior to July 2016this role, he was Senior Vice President, Chief Communications Officer, Public Affairs and Senior Director, Head of Portfolio Analysis Group from September 2011 to November 2013 for GlaxoSmithKline plc,Investor Relations at Forest Labs where he built a multinational pharmaceutical company. Before that, he served for five years in commercialconsolidated corporate communications and capital financeinvestor relations team and led integration efforts. Mr. Kelly has held additional roles at MedImmune, LLCBausch + Lomb, Merck, Schering-Plough, Novartis, Pharmacia, and three years as a plant controller at Uniqema (previously a divisionPharmacia & Upjohn. Previously, Mr. Kelly was the Chair of Imperial Chemical Industries Plc). Mr. Ansari received a B.S.the HealthCare Institute of New Jersey and the Vice Chair of the California Life Sciences Association. He earned his Bachelor of Science in chemical engineering and an M.B.A.Pharmacy from Purdue University. Mr. Ansari is also a Certified Public Accountant.

Alan List, M.D.Christopher Heery, M.D. has served as our Chief Medical Officer since May 2019.April 2021 and, prior to that, had been a strategic clinical advisor to the Company and our Board since April 2020, providing advice regarding our clinical stage and pre-clinical allogeneic CAR T programs. Prior to joining us, Dr. HeeryList served in various roles at the Moffitt Cancer Center, including as President and Chief Executive Officer from 2012 to December 2019, Executive VP, Physician in Chief from 2008 to 2012 and Chief of the Malignant Hematology Division from 2003 to 2008. Prior to joining the Moffitt Cancer Center, Dr. List held academic and clinical appointments at the University of Arizona. Dr. List is internationally recognized for his many contributions in the development of effective treatment strategies for myelodysplastic syndrome (“MDS”) and acute myeloid leukemia. His pioneering work led to the development of Revlimid (lenalidomide) a transformational treatment for patients with MDS and multiple myeloma.

Dr. List is the author of more than 425 peer-reviewed articles and books. He currently serves on the Board of Directors of Morphogenesis, Inc and previously served as Chief Medical Officer at Bavarian Nordic A/S,the President for the Society of Hematologic Oncology as well as a biotechnology company, from October 2016 to April 2019, where he oversaw clinical development programs for its immune-oncology and infectious disease portfolios. Prior to that, he was a Staff Clinician and then an Associate Research Physician and Headmember of the Clinical Trials GroupMDS Foundation Board of Directors. Dr. List is also an active member of the LaboratoryAmerican Society of Tumor ImmunologyClinical Oncology, the American Society of Hematology and Biology atthe American Association for Cancer Research. He is a Charter Fellow in the National Cancer Institute (“NCI”), a U.S. government health agency, from April 2012 to November 2013 and November 2013 to September 2016, respectively, where he was partAcademy of a larger effort to create new immunotherapies for the treatment of cancer. He joined the NCI Medical Oncology Branch as a Medical Oncology Fellow in 2009 and also served asInventors, an Adjunct Appointmentinductee in the Genitourinary Malignancies Branch.Florida Inventors Hall of Fame. Dr. HeeryList received B.S. and M.S. degrees from Bucknell University and earned his M.D. from the University of Pennsylvania. He is board certified in Medical Oncology and Internal Medicine. He received a B.A. from Duke University and a M.D. from East Carolina University Brody School of Medicine, and completed his internal medicine, residency at the University of Illinois at Chicago.hematology, and medical oncology.

Dario Scimecahas served as our General Counsel since June 2019. Prior to joining us, Mr. Scimeca served in various roles for Genentech, a biotechnology company, U.S. affiliate of Roche, from January 2013 to June 2019, including most recently as Assistant General Counsel, where he counseled on legal issues associated with the development and commercialization of multiple drug oncology and rare disease products. Prior to that, he was corporate counsel at Elan Pharmaceuticals where he, among other things, oversaw FDA and EMA regulatory compliance matters. He has previously worked in both corporate transactional law and patent litigation at

13

three national law firms. Mr. Scimeca received a B.S. from Santa Clara University, his J.D. from the University of California, Berkeley, School of Law, and clerked for Judge James L. Dennis on the United States Fifth Circuit Court of Appeals in New Orleans, Louisiana.

Jeff Smith, Ph.D.,Fayaz Khazi, Ph.D. a co-founder of Precision, has served as the CEO ofbeen our food-focused subsidiary, Elo Life Systems,Chief Research Officer since May 2018 and, prior to that, served as President of Elo Life Systems beginning in May 2017. From May 2014 to April 2017,September 2022. Dr. Khazi served as the CEO of KeyGene USA, an agricultural biotechnology company. Dr. Khazi also held several executive leadership positions at Intrexon Corporation directing translation programs in the food, human health and agricultural biotechnology sectors, including serving as Vice President, Business Analytics and Strategy from January 2012 to January 2014, and also serving as Intrexon’s founding Director of Translational Medicine. Dr. Khazi received a B.Sc. from the University of Agricultural Sciences, Bangalore, and a Ph.D. in biological sciences from Auburn University. He trained as a Howard Hughes Medical Institute post-doctoral fellow and a senior researcher at the Children’s Hospital of Philadelphia, where he studied the genotoxicity of gene therapy vectors and developed in vivo genome-editing technologies to treat genetic diseases.

14

Our Board of Directors has adopted Corporate Governance Guidelines. A copy of these Corporate Governance Guidelines can be found in the “Corporate Governance” section of the “Investors & Media”“Investors” page of our website located at www.precisionbiosciences.com, or by writing to our General Counsel and Secretary at our offices at 302 East Pettigrew Street, Suite A-100, Durham, North Carolina, 27701. Among the topics addressed in our Corporate Governance Guidelines are:

• | | | Board size, independence and qualifications | | | • | | | Stock ownership |

• | | | Executive sessions of independent directors | | | • | | | Board access to senior management |

• | | | Board leadership structure | | | • | | | Board access to |

• | | | Selection of new directors | | | • | | | Board self-evaluations |

• | | | Director orientation and continuing education | | | • | | | Board meetings |

• | | | Limits on board service | | | • | | | Meeting attendance by directors and non-directors |

• | | | Change of principal occupation | | | • | | | Meeting materials |

• | | | Term limits | | | • | | | Board committees, responsibilities and independence |

• | | | Director responsibilities | | | • | | | Succession planning |

• | | | Director compensation | | | • | | | Risk management |

Our Corporate Governance Guidelines provide our Board of Directors with flexibility to combine or separate the positions of Chairperson of the Board and Chief Executive Officer in accordance with its determination that utilizing one or the other structure would be in the best interests of the Company and its stockholders. If the Chairperson of the Board is a member of management or does not otherwise qualify as independent, our Corporate Governance Guidelines provide for the appointment by the independent directors of a lead independent director (the “Lead Director”). The Lead Director’s responsibilities include, but are not limited to: presiding over all meetings of the Board at which the Chairperson of the Board is not present, including any executive sessions of the independent directors; approving Board meeting schedules and agendas; and acting as the liaison between the independent directors and the Chief Executive Officer and Chairperson of the Board. Our Corporate Governance Guidelines provide that, at such times as the Chairperson of the Board qualifies as independent, the Chairperson of the Board willmay serve as Lead Director.

The positions of our Chair of the Board and our Chief Executive Officer and President are currently served by two separate persons. Mr. Buehler serves as Interim ChairmanChair of the Board, and Mr. KaneAmoroso serves as our Chief Executive Officer and President. In his capacity as the independent InterimChair of the Board, Chair, Mr. Buehler performs the functions of the Lead Director.

The Board believes that our current leadership structure of Chief Executive Officer and Chair of the Board being held by two separate individuals is in the best interests of the Company and its stockholders and strikes the appropriate balance between the Chief Executive Officer and President’s responsibility for the strategic direction, day-to day-leadership and performance of our Company and the Chair of the Board’s responsibility to guide overall strategic direction of our Company and provide oversight of our corporate governance and guidance to our Chief Executive Officer and President and to set the agenda for and preside over Board meetings. We recognize that different leadership structures may be appropriate for companies in different situations and believe that no one structure is suitable for all companies. Accordingly, the Board will continue to periodically review our leadership structure and make such changes in the future as it deems appropriate and in the best interests of the Company and its stockholders.

Under our Corporate Governance Guidelines and the applicable Nasdaq Stock Market LLC (“Nasdaq”) rules (the “Nasdaq rules”), a director is not independent unless the Board affirmatively determines that he or she does not have a direct or indirect material relationship with us that could compromise his or any of our subsidiaries.her ability to exercise independent judgement in carrying out his or her responsibilities as a director. In addition, the director must not be precluded from qualifying as independent under the per se bars set forth by the Nasdaq rules.

15

Our Board has undertaken a review of its composition, the composition of its committees and the independence of our directors and considered whether any director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our Board of Directors has determined that none of Melinda Brown, Kevin J. Buehler, Stanley R. Frankel, M.D., Geno Germano, Raymond Schinazi Ph.D.Shari Lisa Piré, Shalini Sharp and Tony Yao, M.D.,Samuel Wadsworth, Ph.D., representing fivesix of our seven directors, has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors qualifies as “independent” as that term is defined under the Nasdaq rules. Furthermore, the boardOur Board of directorsDirectors determined that during his service as a director during 2019, Robert Adelman, M.D.each of Raymond Schinazi, Ph.D., D.Sc. and Shalini Sharp qualified as an independent director“independent director” under applicablethe Nasdaq rules. rules during the period served on our Board in 2022 until their departures on November 5, 2022 and May 10, 2022, respectively.

In making this determination, our Board of Directors considered the relationships that each non-employee director has with us and all other facts and circumstances our Board of Directors deemed relevant in determining their independence, including the director’s beneficial ownership of our common stock and the relationships of our non-employee directors with certain of our significant stockholders.

Our Board of Directors has threefour standing committees: an audit committee, a compensation committee, and a nominating and corporate governance committee and a science and technology committee, each of which has the composition and the responsibilities described below. In addition, from time to time, special committees may be established under the direction of our Board when necessary to address specific issues. Each of the audit committee, the compensation committee, and the nominating and corporate governance committee and the science and technology committee operates under a written charter.

Director | | | Audit Committee | | | Compensation Committee | | | Nominating and Corporate Governance Committee | | | Science and Technology Committee |

Melinda Brown | | | Chair | | | — | | | — | | | — |

Kevin J. Buehler | X | | | — | | | X | | | — | ||

Stanley R. Frankel, M.D. | — | | | — | | | — | | | Chair | ||

Geno Germano | X | | | Chair | | | — | | | X | ||

Shari Lisa Piré | — | | | X | | | Chair | | | — | ||

Samuel Wadsworth, Ph.D. | — | | | — | | | — | | | X |

Our audit committee is responsible for, among other things:

appointing, approving the compensation of, and assessing the independence of, our registered public accounting firm;

overseeing the work of our independent registered public accounting firm, including through the receipt and consideration of reports from such firm;

reviewing and discussing with management and our independent registered public accounting firm our annual and quarterly financial statements and related disclosures;disclosures, including our earnings press releases;

considering whether to recommend to the Board that the Company’s audited financial statements be included in the Company’s Annual Report on Form 10-K;

coordinating our boardBoard of directors’Directors’ oversight of our internal control over financial reporting, disclosure controls and procedures and code of business conduct and ethics;

discussing our risk management policies;policies with respect to risk assessment and risk management, financial, cybersecurity and information security risks;

assisting the Board in its oversight of risk management in areas affecting or related to financial, cybersecurity and information security risks;

overseeing our policies and strategies with respect to environmental, sustainability and social matters that may have a material impact on our financial statements or finance-related initiatives;

16

meeting independently with our internal auditing staff, if any, independent registered public accounting firm and management;

reviewing and approving or ratifying any related person transactions;

pre-approving all audit and non-audit services provided to us by our independent auditor (other than those provided pursuant to appropriate preapproval policies established by the committee or exempt from such requirement under SEC rules);

establishing procedures for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters, and for the confidential and anonymous submission by our employees of concerns regarding questionable accounting or auditing matters; and

preparing the audit committee report required by SEC rules.

Our audit committee currently consists of Melinda Brown, Kevin J. Buehler and Geno Germano, and Shalini Sharp, with Ms. SharpBrown serving as chair. All members of our audit committee meet the requirements for financial literacy under the applicable Nasdaq rules and regulations. Our Board of Directors has affirmatively determined that each member of our audit committee qualifies as “independent” under Nasdaq’s additional standards applicable to audit committee members and Rule 10A-3 of the Exchange Act of 1934, as amended (the “Exchange Act”) applicable to audit committee members. In addition, our Board of Directors has determined that each of Ms. Brown, Mr. Buehler and Ms. Sharp eachMr. Germano qualify as an “audit committee financial expert,” as such term is defined in Item 407(d)(5) of Regulation S-K. During her service on our audit committee in 2022, Shalini Sharp qualified as “independent” under Nasdaq rules applicable to audit committee members and under Rule 10A-3 of the Exchange Act.

Our compensation committee is responsible for, among other things:

reviewing and approving, or recommending for approval by the boardBoard of directors,Directors, the compensation of our Chief Executive Officer and our other executive officers;

overseeing and administering our cash and equity incentiveequity-based plans;

reviewing and discussing annually with management our “Compensation Discussion and Analysis,” to the extent required; and

preparing the annual compensation committee report required by SEC rules, to the extent required.

reviewing our compensation policies and practices and assessing whether such policies and practices are reasonably likely to have a material adverse effect on us by encouraging excessive risk-taking; and

assisting the Board in its oversight of risk management in areas affecting or related to our executive compensation plans and arrangements.

Our compensation committee currently consists of Geno Germano Raymond Schinazi Ph.D.and Shari Lisa Piré, and Shalini Sharp, with Dr. SchinaziMr. Germano serving as chair. Our Board of Directors has determined that each member of our compensation committee qualifies as “independent” under Nasdaq’s additional standards applicable to compensation committee members and is a “non-employee director” as defined in Section 16b-3 of the Exchange Act.

During her service on our compensation committee in 2022, Shalini Sharp qualified as “independent” under Nasdaq rules applicable to compensation committee members and as a “non-employee director” as defined in Section 16b-3 of the Exchange Act.

The compensation committee generally considers the Chief Executive Officer’s recommendations when making decisions regarding the compensation of non-employee directors and executive officers (other than the Chief Executive Officer). Pursuant to the compensation committee’s charter, the compensation committee has the authority to retain or obtain the advice of compensation consultants, legal counsel and other advisors to assist in

17

carrying out its responsibilities. Before selecting any such consultant, counsel or advisor, the compensation committee reviews and considers the independence of such consultant, counsel or advisor in accordance with applicable Nasdaq rules. We must provide appropriate funding for payment of reasonable compensation to any advisor retained by the compensation committee.

Compensation Consultants

The compensation committee has the authority under its charter to retain outside consultants or advisors, as it deems necessary or advisable. In accordance with this authority, the compensation committee has engaged the services of CompensiaAon as its independent outside compensation consultant.

consultants.

As requested by the compensation committee, in 2019, Compensia’s2022, Aon’s services to the compensation committee included assisting us in developing our peer group composition, analyzing benchmarking data with respect to our executives’ overall individual compensation and providing information regarding current trends and developments in executive compensation, equity-based awards, severance agreements and employee stock purchase programs based on our peer group.

All executive compensation services provided by CompensiaAon during 20192022 were conducted under the direction or authority of the compensation committee, and all work performed by CompensiaAon was pre-approved by the compensation committee. Neither CompensiaAon nor any of its affiliates maintains any other direct or indirect business relationships with us or any of our subsidiaries. The compensation committee evaluated whether any work provided by CompensiaAon raised any conflict of interest for services performed during 20192022 and determined that it did not.

Additionally, during 2019, Compensia did not provide any services to us other than regarding2022, a subsidiary of Aon served as broker for our directors and officers insurance policy. The aggregate fees incurred with Aon in 2022 for determining or recommending the amount or form of executive and director compensation were $106,907, and broad-based plans that do not discriminatethe aggregate fees paid to the Aon subsidiary in scope, terms, or operation,2022 in favor ofconnection with serving as broker for our executive officers or directors and that are available generallyofficers insurance policy were $250,000. The engagement of the Aon subsidiary to all salaried employees.serve as broker for our directors and officers insurance policy was recommended by management and approved by the Board.

Our nominating and corporate governance committee is responsible for, among other things:

identifying individuals qualified to become members of our Board consistent with the criteria approved by the Board;

recommending to our Board the persons to be nominated for election as directors and to each committee of the Board;

developing and recommending to our boardBoard of directorsDirectors corporate governance guidelines, and reviewing and recommending to our boardBoard of directorsDirectors proposed changes to our corporate governance guidelines from time to time; and

overseeing a periodic evaluationassessments of our boardBoard of directors.

assisting the Board in its oversight of risk management in areas affecting or related to Board organization, membership and structure, and corporate governance.